Fed Comments Were Hawkish – Wait For Support and Sell Put Spreads

Posted 9:30 AM ET - Yesterday the Fed raised rates for the third time in six months. Their rhetoric was more hawkish than expected and they left the door open for another rate hike this year. Tech stocks sold off and we are seeing more profit-taking before the open this morning.

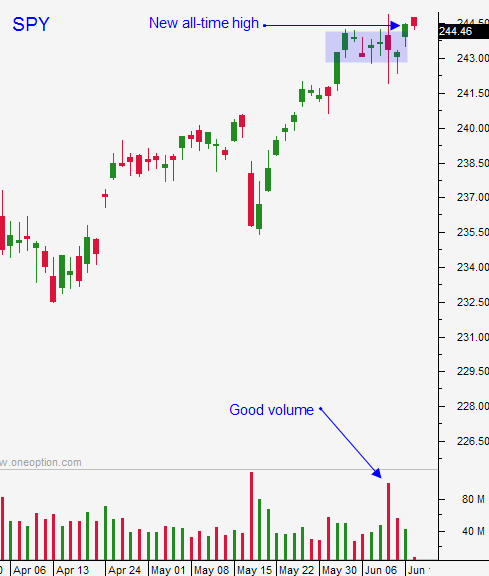

This is the decline that we've been waiting for. Once support is established swing traders need to sell out of the money bullish put spreads. Key support on the SPY is $240 and it is $136 for the QQQ. I believe the market will find support at those levels and we might not make it that low. If the selling quickly abates this morning and the market does not make a new low after two hours of trading, consider selling a few put spreads. If the market continues to drift lower throughout the day hold off.

The summer doldrums will set in next week and these spreads will take advantage of time decay. Earnings season will begin in a few weeks and that should keep buyers engaged. They will pull bids this morning and they will let the market come in. Once support is established they will start nibbling.

Economic growth is moderating and less than half of the Fed officials believe that another rate hike will happen this year.

Day traders should wait for support this morning. SPY $243, $242 and $240 are the levels to watch. I would like to see an early drop and a bounce. A retest that produces a higher low will signal a good entry point for longs. If the market continues to drift lower after the first two hours I will short S&P futures. It is easier to trade one instrument and I need to be nimble. Short covering rallies in a bull market can be violent and I do not want to be spread out across many stocks. I love trading down opens and I will be favoring the long side.

Quadruple witching is tomorrow and we can expect good volume and volatility.

Watch the key levels I've outlined and look for opportunities to sell out of the money bullish put spreads.

.

.

Daily Bulletin Continues...