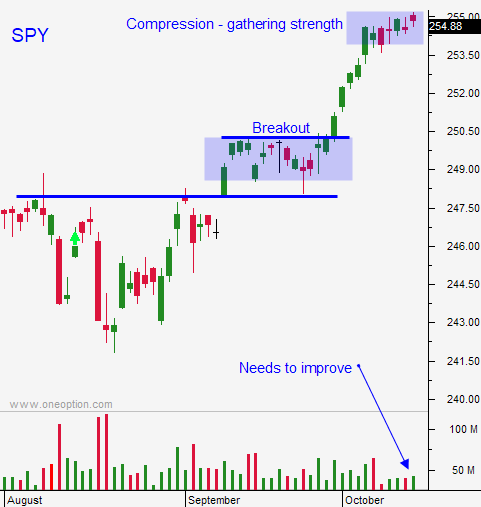

Solid Earnings Will Fuel the Rally This Week – Stay Long

Posted 9:30 AM ET - The market will continue to grind higher this week. Strong earnings will fuel the rally and announcements will be heavy. Amazon, Bidu, Google, Intel and Microsoft will post after the close Thursday. Hang and your calls and ride this wave higher.

Q3 guidance was the strongest we've seen in five years and the results should be excellent. 70% of the companies that are in the S&P 500 have exceeded estimates so far. The strongest companies announce early in the cycle and optimism builds. Seasonal strength will also fuel the move.

Trump might announce his choice to lead the Fed this week. The most market friendly choice would be Yellen since she is a known commodity. The next FOMC meeting is on 11/1.

Republicans have a couple of months to get a tax deal passed. If they can't get it done by December the focus will shift back to the debt ceiling. The next round of debt ceiling negotiations will get nasty because the GOP will try to "kick the can" down the road as far as possible.

The economic news has been good. Job growth has been lackluster, but the hurricanes had a major impact. Last week we saw the biggest drop in initial claims in years. Reconstruction after the storms will fuel employment.

Right now earnings are all that matter. Look for a nice solid rally. This will be the last good move of the year.

Swing traders should stay long calls and use SPY $255 as a stop on a closing basis. Start taking profits above $260 and gradually scale out.

Day traders should stay on the sidelines unless the market rallies above the first hour high. If that happens, you can passively get long. Intraday volatility has collapsed and the majority of the moves have come overnight. I am personally only day trading when the market opens lower. I am swing trading more.

Momentum, seasonal strength, strong earnings and decent economic news will push the market higher. I don't see any speed bumps for a few weeks.

.

.

Daily Bulletin Continues...