Short the Gap Up This Morning – Dull Trading Ahead

Posted 9:30 PM ET - Yesterday the market traded in a tight range and lackluster trading will continue for another week or two. The news is light and the upward momentum from the bounce has stalled.

Trade negotiations with China are strained and I don't believe we will see a deal before the 2020 election. China is preparing fiscal and monetary stimulus to prop up growth. This signals that they are preparing for a prolonged trade war. Trump has threatened to raise tariffs if Xi does not attend the G20 meeting on June 28th. Huawei is still blacklisted and we can expect retaliation from China if it continues much longer.

China will post industrial production and retail sales tomorrow. I am expecting light numbers, but it won't matter. Traders will rationalize that China will add more stimulus.

Europe and Japan are not as fortunate, they are out of monetary bullets. Interest rates are at 0% and central banks can't cut rates. Their only recourse is to postpone future rate increases. Economic conditions around the globe are deteriorating.

The FOMC will meet next week and I believe the comments will be dovish. Traders will be looking for a rate cut timeline, but I doubt they will get one. In my opinion I believe that September is the earliest we will see a rate cut and it will only happen if domestic economic growth starts to slip. The market is pricing in two rate cuts for 2019 and I believe that is overly optimistic.

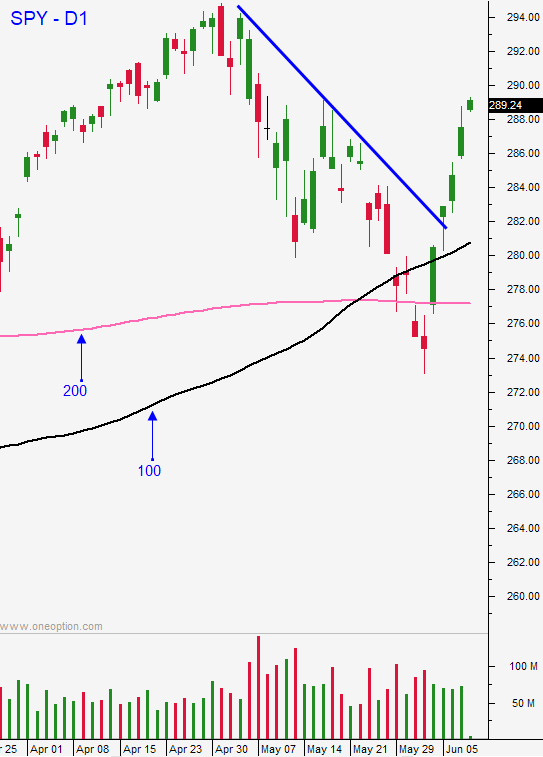

The market sold off in May and it bounced last week. It will establish a trading range (summer doldrums) and we will test the 200-day moving average later this summer.

Swing traders should remain short. Use the all-time high as your stop on a closing basis. I believe that the momentum has stalled and that we will see some selling in the next few days.

Day traders should look for opportunities to get short on the open this morning. I don't believe the gap higher will hold. We have seen 3 higher opens and lower closes. We have also seen late day selling and follow through the next day. These are signs that the bounce has run its course.

Look for tight trading ranges intraday and a negative bias.

.

.

Daily Bulletin Continues...