Too Early For Swing Traders To Buy – More Downside

Posted 9:30 AM ET - The first wave of selling after a new all-time high tends to be swift and deep as "weak hands" fold. Investors priced in best case scenarios and they did not pan out. The 100-day moving average failed with ease and we never bounced to test it. I view this as a bearish price action and it tells me that there is more selling to come.

US/China trade negotiations have deteriorated and new tariffs will be imposed on $300 billion worth of goods in September. Trump is fully aware that China is playing games and that they will not sign an agreement before the 2020 election. China's currency plunged yesterday and the PBOC stepped in to support it after being accused of currency manipulation. A weak currency may preserve trade, but it threatens foreign investment and China needs to tread cautiously.

Trump is likely to focus on trade deals with Mexico, Canada and Japan. That is the lowest hanging fruit and a trade deal will calm the seas.

Many analysts are talking about the Fed's hawkish tone. That couldn’t be farther from the truth. They cut rates by a quarter-point and they ended the balance sheet roll-off two months early. This is a 180° pivot from where they were a year ago. The market is addicted to easy money and investors threw a temper tantrum when a September rate cut was not promised. Domestic economic growth is strong, China's growth has temporarily stabilized and the market was close to an all-time high last week. The Fed has plenty of breathing room.

Stock valuations are at the upper end of their trading range (forward P/E of 17). Optimism was too high and some of the "fluff" is being taken out. Most of the mega cap tech stocks (FAANGs) sold off after reporting.

England is headed for a hard exit in October and this dark cloud is slowly advancing. There is always the possibility of an extension, but the EU is steadfast in their terms and they are not in the mood to negotiate.

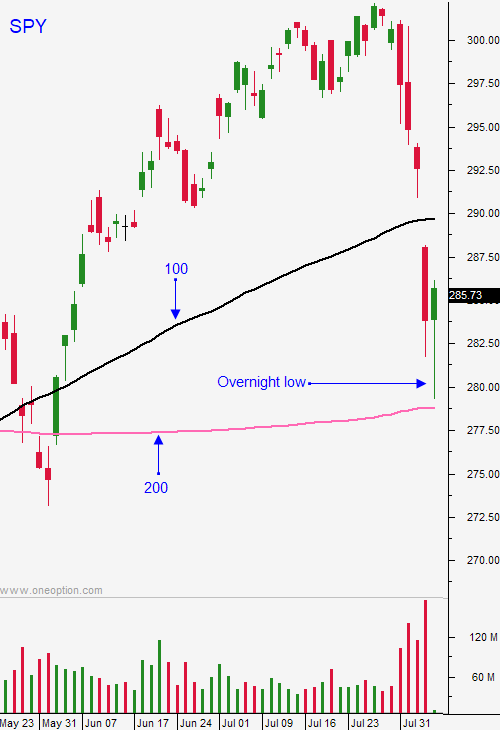

Swing traders should use an intraday stop of $288.20 on the remaining half position (we sold half of our position yesterday). We will also set a target of $279. We don't want the SPY to fill in the gap from yesterday. I still believe we have more work to do on the downside and the market should test the 200-day moving average in the next two weeks. There will be bounces along the way. We want to take profits on our positions (particularly options) while the market is still dropping. Put buyers benefited from the market decline and from an explosion in option implied volatilities. We are in a news vacuum and that favors the current momentum. Do not buy now; we still have work to do on the downside. This is a normal correction within a bull market and a buying opportunity will present itself.

Day traders should watch the open this morning. The S&P 500 almost touched the 200-day moving average overnight and it reversed. We are seeing some of that buying spillover this morning and the S&P 500 is up 25 points before the open. We should expect a nice two-sided trading today, but this is just a bounce. The market will not have a meaningful rally until the downside is tested and that means visiting the 200-day moving average during normal trading hours. If the gap up this morning crumbles I will favor the short side. If we find support early and we start grinding higher I will favor the long side. Go with the momentum and take profits when it stalls. Expect decent directional moves that last an hour and reverse. We have seen very heavy selling the last week and we should get a reprieve. That means choppy two-sided trading for the next few days.

August is traditionally a slow month. Earnings season is winding down, the calendar is light (no major economic releases), Fed/politicians are in recess and traders are taking time off before their kids go back to school. Trading volume will decline and intraday ranges will compress in the next week.

.

.

Daily Bulletin Continues...