Let Your Profits Run – Market Will Inch Higher This Week

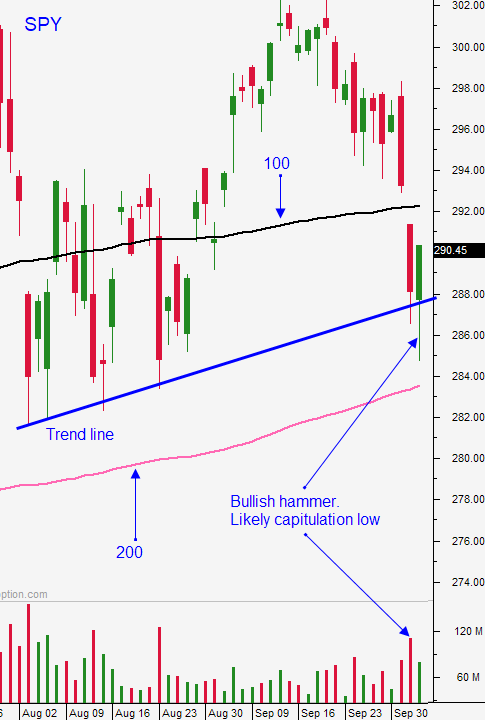

Posted 9:30 AM ET - Last week the market fell through horizontal support at SPY $294 and it breached the 100-day moving average. Thursday we plunged to the 200-day moving average on weak economic news and we missed our entry point for a long position by a whisker. The sharp intraday reversal on Thursday formed the bullish hammer we have been waiting for and it presented an excellent buying opportunity. We bought the open Friday and our position is in nice shape. I'm expecting a grind higher this week.

ISM manufacturing declined well into contraction territory and that sparked selling on Tuesday. A soft ADP number and a big drop in ISM services added fuel to the fire. The deep low Thursday morning was scooped up by Asset Managers and we had the capitulation low we have been waiting for. The "bad news is good news" crowd took advantage of the dip.

As I mentioned in my comments, central banks are providing a safety net. Historically low bond yields are forcing investors to buy equities. Interest rates do not keep pace with inflation and fixed income investors have negative real rates of return. As long as credit concerns remain low this force will attract buyers at major technical support levels.

The Fed will be more likely to ease in 2019 after a soft round of economic data. They've said that they are closely monitoring activity and that they are prepared to cut rates if conditions soften.

Earnings season will begin next week. Stocks are trading at the upper end of their valuation range and good news is expected. There have not been many pre-announcement warnings and the bid should remain strong.

Face-to-face trade negotiations with China will resume later this week. Rumor has it that the scope of the negotiations has been narrowed and that there are certain items that are not up for debate. In my opinion this is a charade and both countries are simply trying to stabilize their respective markets. There will not be a trade deal before the 2020 election.

The economic news is light this week.

Swing traders should place a stop at $292.40 (closing basis). We want the 100-day moving average to hold. Place a target at SPY $298.50. If we are filled that would represent a nice profit on a full position. We have been selling out of the money bullish put spreads on strong stocks and they are in excellent shape. My market bias is neutral to slightly bullish and this strategy allows us to distance ourselves from the action and to generate income from time decay. Make sure the short strike price is below technical support and buy the spread back if that support is breached.

Day traders should wait for support, then trade from the long side. Use the 100-day MA as your guide. We want that level to hold. If the market gets above $294 you can trade from the long side and lean on that level. The early drop this morning is just giving back the gains that we had in the last half hour of trading on Friday. I'm not overly concerned with it and I believe we will get follow-through buying after the capitulation low from last week.

China's market is closed for holiday and the volume has been particularly light on Mondays. This should be a quiet start to the week. Be patient, wait for support and buy stocks with relative strength.

.

.

Daily Bulletin Continues...