Market Will Open Through Resistance Today – FOMC Statement Will Be Bullish

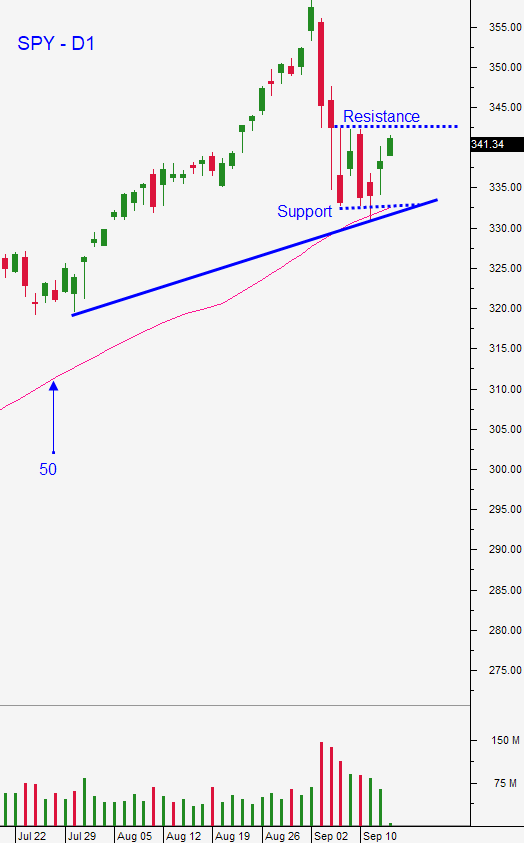

Posted 9:30 AM ET - The S&P 500 bounced off of the 50-day moving average and the opening gap higher on Monday held throughout the day. Buyers are nibbling after SPY $332 was tested three times last week. We are likely to see a bounce for the remainder of the week fueled by a dovish FOMC statement on Wednesday. The duration and magnitude of this bounce will reveal the strength of the market bid. If the bounce lasts a couple of weeks, the retest of support will be brief and stocks will float to the all-time high. If this bounce lasts less than a week and we breach the 50-day moving average, the next leg of the decline is likely to test the 100-day moving average.

Rumor has it that Democrats are pressuring Nancy Pelosi to negotiate a stimulus bill. If this is remotely possible the market bid will strengthen.

The FOMC statement will be dovish. Fed officials have stated that they are willing to let inflation run above the 2% target.

The economic data points this week are fairly minor. Empire Manufacturing came in better-than-expected (17 versus 6.5). ISM Manufacturing and ISM services numbers were good last week. They are surveys and they are forward looking. Economic data points from China are also encouraging and they suggest a "V" recovery.

Stock valuations are stretched at a P/E of 23. Great news is priced in and there is room for disappointment. Federal Express and Adobe will post results after the close today.

Swing traders should remain in cash. The market drop during the last two weeks was a warning sign. Bullish speculation resulted in a buying climax and we need to gauge profit-taking. A nice gradual market bounce that lasts a couple of weeks would be bullish. A brief bounce that lasts a few days with an immediate retest of the 50-day moving average would be bearish. It's very possible that the market spends the next two months between the all-time high and SPY $332. Stocks need time to grow into current valuations and the economy needs to show steady signs of recovery. The polls are within the margin of error and the election will also keep a lid on the market. If support at the 50-day moving average is not tested in the next two weeks we will start selling out of the money bullish but spreads.

Day traders should focus on the long side today. Wait for the bid to be tested and buy stocks with relative strength. Yesterday's price action was fairly bullish and we are seeing follow-through overnight. There is still selling pressure so make sure to take profits when the rally stalls. Opening gaps higher are difficult to trade because we need to patiently wait in the first 30 minutes of trading to see if profit-taking sparks a reversal. Unfortunately, there are times when much of the move happens in that first half-hour. Relative strength is difficult to identify during these gaps higher because all stocks rally with the market. The fakes instantly reverse and early buyers sustain losses. I don't like getting trapped in a bad trade so I don't chase opening gaps higher. If the gap falters (or stalls) I can spot relative strength and I can identify price patterns that suggest market support. Armed with this information I can buy stocks with relative strength. Yesterday the market gapped higher and rallied hard for the first hour. That was the move of the day. If we see this type of move today, I will be relatively passive. I want to trade from the long side today, but I will be patient. The action could slow down dramatically this afternoon ahead of the FOMC statement tomorrow.

Support is at SPY $332 and $337.50. Resistance is at $340 and $342.50.

.

.

Daily Bulletin Continues...