The Market Is Trying To Establish Support – Here’s the FOMC Reaction I’m Expecting

Posted 9:30 AM ET - The market is trying to establish support after a pullback during the last two weeks. Dovish Fed comments are expected today and House Democrats will not take recess in October unless a stimulus bill has been passed. The market bid is firm, but profit takers will keep a lid on the rally if prices get overextended. Valuations are stretched and there is room for disappointment. In short, buyers and sellers are paired off.

The Fed will keep interest rates low even if inflation rises above the 2% target. This is extremely dovish and officials have implied that they have done all they can to stimulate economic growth and that now it is time for politicians to take action (fiscal stimulus).

The fact that politicians are committed to forging a stimulus bill is encouraging, but this might be lip service ahead of the election.

Economic data points have been good. Retail sales increased .6% and that is slightly below the 1% estimate.

Based on option open interest day-to-day there does not seem to be a large influence one way or the other as we head into quadruple witching. On an end-of quarter basis fund rebalancing should also have a negligible impact. Most funds adjust on a month-to-month basis and they will be buyers. Funds that adjust quarterly will be sellers and there will be zero net effect.

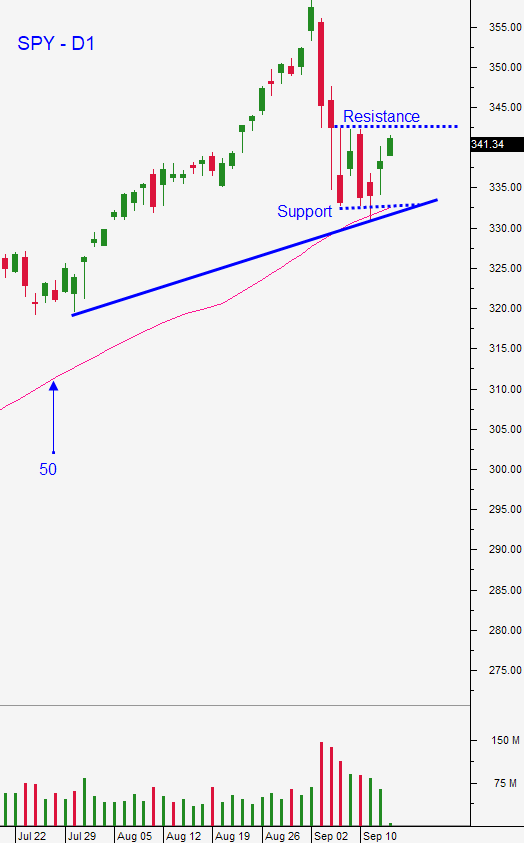

From a technical standpoint the market should try to rally off of support. If this bounce lasts a couple of weeks it will confirm support and this price action would be bullish. If the market is not able to advance and SPY $332 is tested in the next week, we are likely to see additional selling pressure and the market will stage its next leg lower.

Swing traders should be in cash. I will be watching the price action this week and I might sell a few very short-term out of the money bullish but spreads. Buyers and sellers seem to be paired off and the market could be range bound until the election. When I can't get a good read on market direction, I keep my swing trading risk low.

Day traders will have opportunities on both sides. The early action this morning will provide a few trading opportunities, but the movement will stall into the FOMC statement this afternoon. The reaction should be muted. The early gaps higher have gained traction and then profit-taking sets in. I don't know if this pattern will prevail today, but I will be watching for. We will use the 1OP indicator for market direction and we will trade stocks with relative strength/weakness based on those signals. This is our daily routine in the chat room and I'm expecting sideways action.

Support is at SPY $337.50 and resistance is at $342.50. I expect that range to hold today.

.

.

Daily Bulletin Continues...