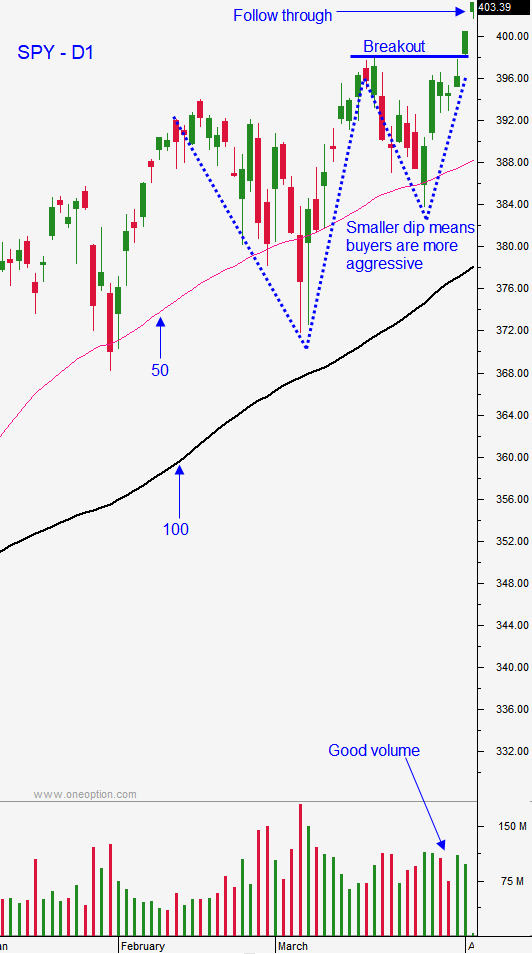

Market Should Remain Strong Into Earnings – Here Is My First Target

Posted 9:30 AM ET - Yesterday the S&P 500 surged to a new all-time high on the heels of a strong employment report Friday. Stocks gapped higher and they held the gains throughout the day. There hasn't been much overnight news and this rally should continue into earnings season. Buyers will be aggressive heading into the announcements since Q4 guidance was strong. The next resistance level is SPY $410.

The economic releases have been excellent the last few weeks. ISM manufacturing and ISM services were robust and both had readings above 63. Jobs are improving and we learned that 916,000 new jobs were created during the month of March. ADP was also much stronger-than-expected last week and we haven't seen these employment levels since last fall. This is a "sweet spot" because the Fed has promised not to “pump the brakes” until 2024.

Coronavirus vaccinations hit a rate of 4 million per day on Sunday. States are reopening and spending will be brisk. Consumer Confidence was very strong last week and we know that the savings rate has hit levels we haven't seen in many years. Almost $2 trillion sits on the sidelines and with stimulus checks in hand we can expect strong retail sales. Some of that money will also find its way into the stock market.

M2 money supply has jumped and the financial system is flush with cash. Credit concerns are low and the financial sector has been grinding higher. Banks will dominate the earnings announcements in the next two weeks and they should be strong.

Tech stocks are starting to gain momentum and this sector is fueling the market breakout. Bonds have established short-term support and the concern over higher interest rates is subsiding.

Swing traders are long SPY. Use a closing stop of $395. That is above our entry point and this stop gives us a little breathing room. As long as the market does not melt up the risk of a drop is fairly low. This rally has been in a pattern where it takes three steps forwards in two steps backwards. I still believe that we have upside to SPY $410 - $412. Your bullish put spreads should be in good shape. Tech stocks look good and you can consider selling some out of the money bullish put spreads on these companies. This sector has been lagging the market. Apart from tech stocks I would ride your current bullish put spreads and roll your other positions during the next market dip.

Day traders should search for relative strength early in the day. The bid will be tested and support should be established early in the day. Look for opportunities to buy stocks with relative strength and heavy volume that are breaking through technical resistance. If the market is above the first hour high you can get a little more aggressive with your longs. After a big rally yesterday and a couple of gaps higher, the market is due for a rest.

Support is at $403.40 and resistance is at $407.

.

.

Daily Bulletin Continues...