More Market Selling Likely – Here’s What To Watch For

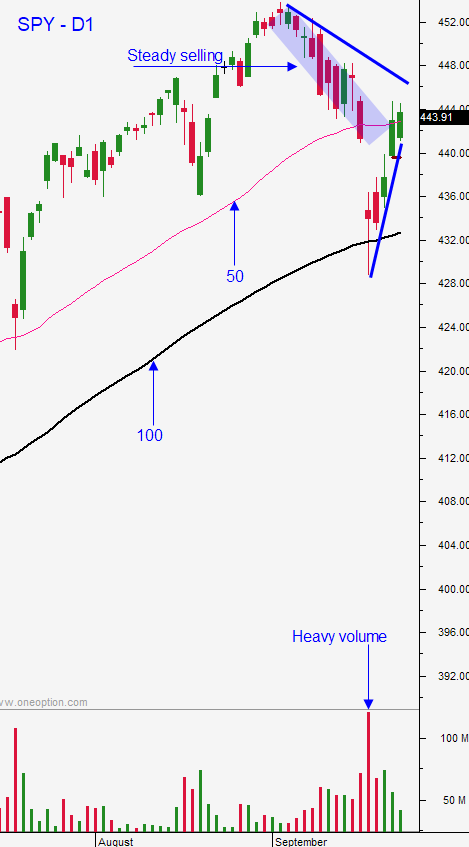

Posted 9:30 AM ET - In my comments yesterday I told you the opening gap higher was likely to fail. All of the losses from Tuesday were preserved Wednesday and I viewed that as a victory for the bears. The selling started early and the market closed on its low of the day and below the 100-day MA Thursday. We have seen a pattern of higher opens and lower closes and that leads me to believe that the gap up today will be faded.

On the bullish side of the ledger the same theme has been playing out for years. Bond yields do not keep pace with inflation (negative real returns) so investors are piling into stocks. Corporations are facing rising raw material costs, labor shortages and supply disruptions. The best investment for many of them is share buybacks and that is also keeping a bid to the market.

On the bearish side of the ledger, stock valuations have not been this high since the tech bubble of 2000. China may have credit issues with the failure of Evergrande and the world is waiting to see how China responds. Electricity is in short supply in China and they are rationing it. This will impact manufacturing. Supply disruptions are surfacing everywhere and this will add to the problem. China’s market is in bear territory and it is within striking distance of the 52-week low. The Fed will start tapering and the market will not like it when they take the punch bowl away. September is a seasonally weak month and TLT is below the 100 and 200-day MAs.

The economic news this week has not had a big impact. ISM manufacturing will be released after the open.

From a technical standpoint we have seen the heaviest selling in a year. The test of the 100-day MA told us that sellers are in command. The market tested that support with a vengeance and we closed below it. Asset Managers who are looking to buy recognize the weakness and they will put their wallets back in their pockets on the notion that they will be able to buy at lower levels. They will wait for signs of support.

Swing traders need to wait on the sidelines. If you sold bullish put spreads last week and the stock has broken key technical support, buy the spread back. Your exposure should be limited since we were only taking a few positions. Option IVs were high providing you with some cushion and stocks with relative strength should still be holding up fairly well. As the market sell-off continues the baby will get thrown out with the bathwater and you need to exit those trades. I do not suggest buying puts if you have a 3-4 week time horizon and if you can’t watch the market during the day. The snap back rallies have been violent and your best opportunity will come on the long side when support has been established.

Day traders should favor the short side. I do not believe this early gap up is going to hold. The best trading scenario for me will be a wimpy rally on the open with tiny bodied candles. When the rally stalls I will be looking for signs of resistance at SPY $437. Ideally, 1OP will spike and in 30 minutes with a bearish cross and there will be candles with tails above body (wicks). If I see that I will start shorting. The selling pressure has been steady and we will test the downside today. Alternatively, we could see a bearish gap reversal. That would be a sign of heavy selling pressure. You will see long red candles stacked (little to no overlap) in the first 30 minutes. I do not believe that we will have a meaningful rally until the downside is tested today. The futures have pared losses overnight, but this has been typical (open on the high, close on the low of the day). I can’t recall the last time that a meaningful market bottom was established in the overnight session. Favor the short side as long as the SPY is < 100-day MA.

Support is at SPY $422 and the 200-day MA. Resistance is at the 100-day and $437.

.

.

Daily Bulletin Continues...