Market Down Big – What Should I Do?

Posted 9:30 AM ET – From a trading standpoint this feels more like “Red Friday”. The S&P 500 is down 80 points before the open and a new variant of Covid has investors spooked. Here are some key themes to be mindful of.

1. Gains from light volume rallies are easily stripped away.

2. Year-end seasonal strength is likely to keep the dips brief and shallow.

3. No one knows if the new variant is more contagious and we do not know if the vaccines will fight it.

4. The credit crisis in Turkey reminds us that many sovereigns are sitting on mountains of debt. Turkey’s credit crisis should not have much of a ripple effect.

5. Goldman Sachs has been very dovish and they were not expecting any rate hikes in 2022. This was their stance just a month ago. Now they are talking about tapering at double speed and 3 possible rate hikes in 2022. This is a complete pivot and the FOMC meeting on December 15th could be a speed bump.

6. Stock valuations have not been this high since the 2000 tech bubble.

What does all of this mean? From a short term trading viewpoint (less than a month) it is another sign of uncertainty and two-sided price action. I have been mentioning for weeks that the opposing forces are very strong and that this is a low probability trading environment. I feel that the new Covid variant provides an excuse to take gains. It will be blamed for the market drop, but there are only 20 new cases in South Africa so we really do not know much about it. I believe the true culprits are higher interest rates, global credit concerns, persistent inflation (not transitory) and complacency (low VIX). This is going to flush out bullish speculators.

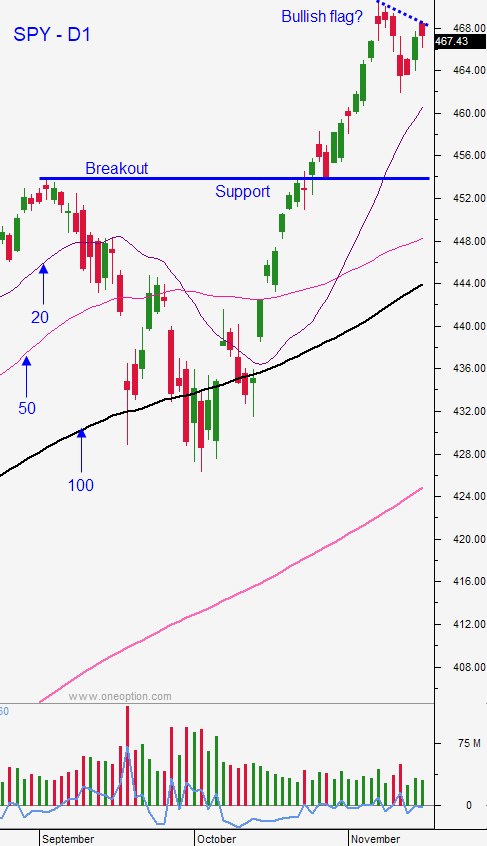

How should swing traders react? We sold our IWM position a week ago. At this stage you should only be short OTM bullish put spreads. We knew a market drop was possible and that was the reason for picking this strategy. I would not panic out of positions on a holiday shortened trading session. Evaluate the price action today. We want the SPY to close above $453. That is the 50-day MA and it has provided support during the last year. That is also horizontal support. Watch your stocks and make sure they are maintaining relative strength and the key technical support levels we were leaning on. Your short strike price should be below that point if you followed our method. I would not adjust the positions until next week. Let this knee jerk reaction run its course and evaluate the position next week under normal conditions. The weekend will allow us to assess the damage and the news.

What should day traders do? Watch for long green candles stacked consecutively on the open with little to no overlap. This is the only pattern I would trade early. It will be a sign that a strong market bounce will unfold today. I would look for stocks that are up (i.e. PFE) or that are barely down this morning. Those will be your strongest plays. A more likely scenario is a gradual and choppy move lower where the bid is tested and then we get sharp bounces. This will be a sign that buyers are still there, but that the selling pressure needs to run its course. The closer we get to $453, the more compressed the candles will become. That will be a sign that a bounce is coming and you will have a chance to buy strong stocks. I would only be trading from the long side today (I am not trading, I just came in to write this game plan for you). If the market keeps drifting lower I would not participate. The chance of sharp snap back rallies will make shorting difficult after such a big drop and that is why I would favor the long side. There will be great movement so pick your entry points wisely.

Support is at SPY $453 and $462. Resistance is at $465.29 and the high from Wednesday.

.

.

Daily Bulletin Continues...