Year End Strength – Sellers Should Be Passive This Week

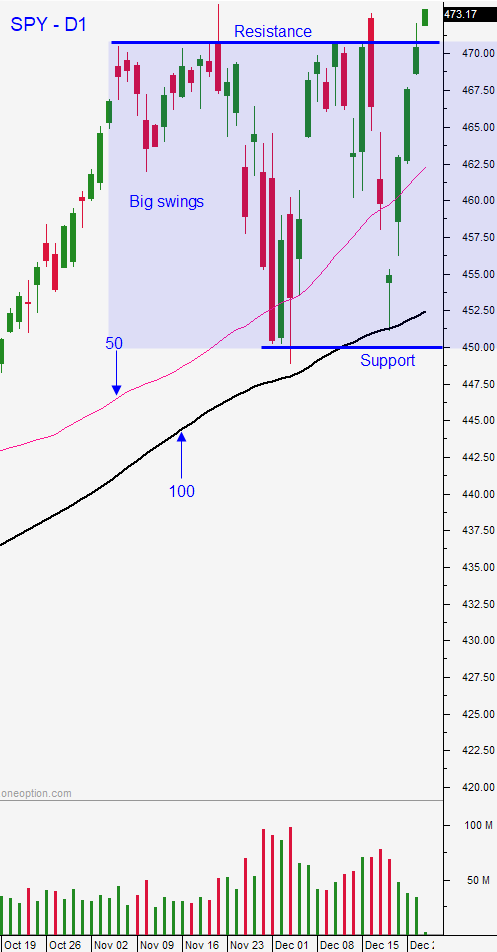

Posted 9:30 AM ET – The S&P 500 is within striking distance of the all-time high and it looks like Santa Claus is coming to town. In the last 95 years the S&P 500 has moved higher from the day after Christmas until the first two trading days of the year 78.5% of the time. Resistance is building at the all-time high and the gains will be hard fought.

We have seen two-sided price action the last few weeks with wild swings. Seasonal strength and corporate buy backs have fueled rallies while inflation, Fed tightening, Omnicron and extreme stock valuations have sparked profit taking.

Swing traders; manage your OTM bullish put spreads. This strategy was selected because it gives the trade breathing room (this came in handy two weeks ago). Time decay is working its magic and your positions should be well out of the money. Your next opportunity will come on the next market drop.

Day traders should take a deep breath. We want to make sure the opening gap holds. There is no reason to buy the open. Gaps up to an all-time high have been faded and we need to make sure this is not a gap reversal. If the gap fills easily in the first 30 minutes, that is a sign of heavy selling. If the market forms support (compressed candles, tails under body, bullish hammer, bullish engulf) before the gap is filled it will be a sign that buyers are engaged. I expect to see choppy, light volume trading. The high from Thursday will be tested right away. If we get through on the first attempt, that will be bullish. Pick your entries carefully and error on the side of NOT trading. Use 1OP as your guide as I outlined in the video this morning.

Support is at SPY $470.50 and resistance is at $472 and $473.50

.

.

Daily Bulletin Continues...