Market Will Struggle To Hold the Gap Today – Here’s Why

Posted 9:30 AM ET – Let’s keep this short and sweet. The S&P 500 is up 70 points overnight on news that Putin is reducing the troop count on the Ukrainian border by 10,000. The S&P 500 will open well above the 200-day MA this morning.

Was a Russian invasion a market threat? Many believe that Putin is just flexing his muscles and that he does not dare to invade the Ukraine. Even if he did, historical data shows that conflicts/wars do not lead sustained market declines.

Earnings season has been incredibly good. Top and bottom line growth has been above the 5-year average according to FactSet. Valuations are stretched, but what else are you going to do with your money when bond yields are not keeping pace with inflation? Large corporations are issuing cheap debt to buy back shares. More cash from central bank money printing chasing fewer shares outstanding means that share prices go up.

The “fly in the ointment” is the Fed’s dovish policy. They got inflation wrong and now they have to slam on the breaks. In just a few months, Fed officials have gone from “no rate hikes in 2022” to “we need to hike rates by 1% fast”. The market does not like shocks and this is a dramatic shift in policy.

The PPI is likely to come in “hot”. Any market surprise (low number) would favor the upside.

Swing traders are flat. We took gains on our SPY position and we are going to wait for the March FOMC meeting. Putin withdrawing 10,000 troops out of 130,000 means nothing. There is an underlying bid to the market, but Asset Managers are going to be relatively passive until the March FOMC statement. Wednesday we will get the FOMC minutes, but the tone has gotten more hawkish in just the last week so I don’t see it having much of an impact (old news).

Day traders should use caution on the open. I doubt the overnight news will spark a massive rally with stacked green candles above the 70 point gain we are already seeing (10%). The market could compress for 45 minutes and float higher (20%). This would give us some time to find stocks with relative strength, but it will be hard to sift through the gainers with such a big opening gap up. If this scenario unfolds, the move will be over in 90 minutes and we will compress the rest of the day. A gradual drift lower with mixed overlapping candles is the most likely scenario (40%). That would be a sign that the bid is fairly strong and that the downward trend will find support in the middle of the gap. The 200-day MA is the likely resting point. This is also our best scenario. We can gauge 1OP and spend time finding stocks with relative strength. The market dip will help us find relative strength. Stacked red candles with little to no overlap are very possible this morning (30%). No one trusts Putin so this is just a relief rally. If we are going to get a gap reversal it will happen instantly on the open. The red candles will test the 200-day MA in the first 30 minutes and it will be breached on the first attempt. This would set up a bearish trend day. You will notice that my forecast of outcomes has a bearish bias this morning. I don’t believe the Russian invasion was the reason for the market decline and I do not believe that removing 10,000 troops will have a lasting market effect this morning. That is my thesis.

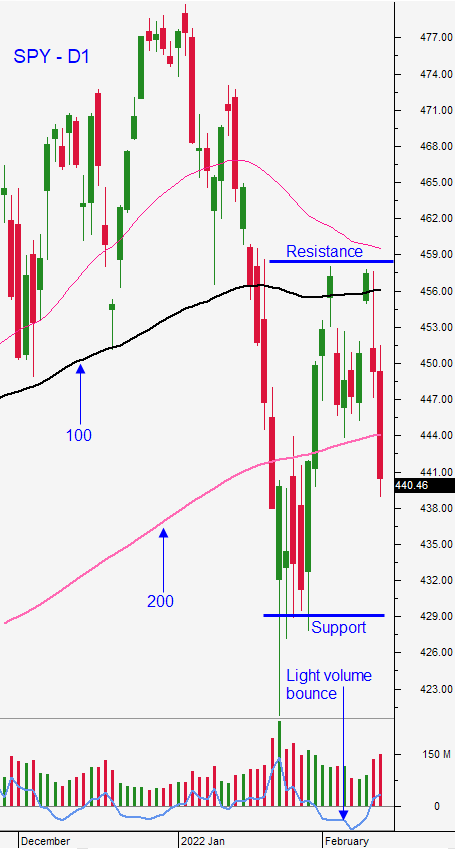

Support is at the 200-day MA and resistance is at $449 and the 100-day MA

.

.

Daily Bulletin Continues...