The Bounce Yesterday Was Only That – Here’s What I Expect Today

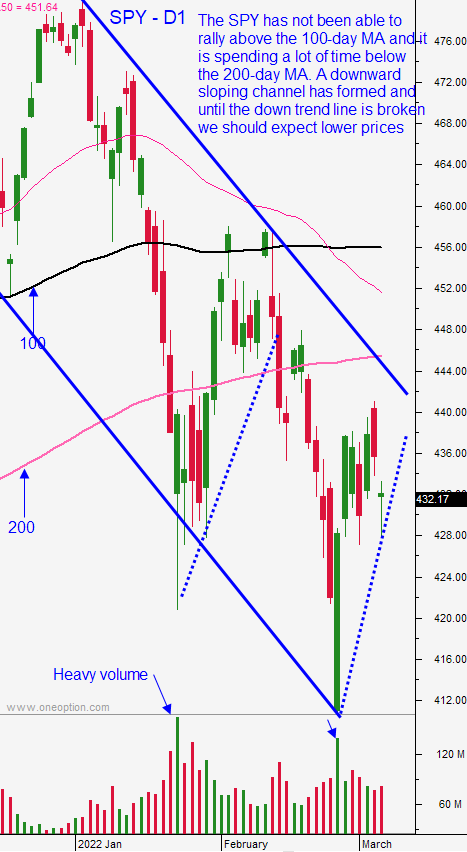

Posted 9:30 AM ET - The rally yesterday felt nice, but it was just an oversold bounce. The market is still trading below all of the major moving averages and it has stayed below them for almost a month. A downward sloping trading channel on the SPY suggests a choppy move lower and any bounce should be viewed as a shorting opportunity.

The CPI was released this morning and as expected it was “hot”. Inflation hit 7.9% annual basis (.8% in February vs .7% expected) and that is the highest reading since 1982. This will put upward pressure on interest rates and the Fed could hike 50 basis points next week.

Asset Managers are not going to aggressively buy ahead of the FOMC statement next Wed. We can expect choppy trading conditions with a downward bias until then.

Any rally related to a cease fire in Ukraine should be faded. Putin won’t stop and there is no turning back. Rightfully, Ukrainians don’t trust Putin and they are bravely fighting for their country. The destruction is heartbreaking.

Swing traders are in cash. After a 12-year bull market rally you assume that every market dip is a buying opportunity until you have technical confirmation of selling. That confirmation is not just a breach of a major support level; the market also needs to spend time below that support level. Until last week I was still in the longer term bullish camp and I suspected that these drops were nervous jitters ahead of the FOMC statement next week. The war in Ukraine added to the selling pressure and those concerns should be waning. In the last week we have not seen buyers aggressively scoop these dips and that is a sign of sustained selling pressure. The SPY has spent 3 weeks below the 200-day MA and it has only been above the 100-day MA twice since January. The selling pressure is sustained and credit issues could start to surface. European banks have been crushed the last week and US banks are also under pressure. This is bearish and my longer term market bias has shifted from bullish to neutral. My short term market bias is bearish. The market is in a downward sloping channel. This pattern tends to be stubborn and we can expect a choppy drift lower. Until we see a selling climax, you should not be buying.

In my comments yesterday I warned day traders that the rally was only a bounce and not to take overnight longs. The longer term and shorter term technicals are bearish. The rally yesterday was confined to bounces in deeply oversold stocks and the leadership was weak. This morning the M5 gap from yesterday is being challenged and I believe the low from Tuesday could be tested before the FOMC statement. The best scenario this morning is a bounce with mixed overlapping green and red candles (40%). That will be a sign that the bounce is weak. When it runs out of steam there will an excellent shorting opportunity and that will provide an opportunity to join the longer term down trend. I give this a relatively high probability because buyers did show some interest yesterday and they will challenge the early selling pressure. A swift drop with stacked red candles is not likely and we do not want to chase. A fairly good scenario is a flat open with a slightly bearish tone. That is also very likely and it will give us a chance to find stocks with relative weakness.

Support is at $418 and resistance is at $428.

.

.

Daily Bulletin Continues...