Heavy Selling Pressure Ahead of Major Releases Is A Bearish Sign

Yesterday, stocks retreated after a massive 10% rally in less than two weeks. The market was grossly oversold and shorts were squeezed ahead of earnings season. That bounce quickly ran its course and the selling was persistent Monday.

The litmus test came yesterday after the close. IBM beat estimates and the stock was pounded in after-hours trading. VM Ware has been a tech leader and it traded lower after posting results. The silver lining throughout all of this turmoil has been earnings. If the market can't climb after the strongest companies announce, the rally is over.

Banks have been beaten down and they were due for a bounce. J.P. Morgan and Wells Fargo declined after posting results. This morning Bank of America and Goldman Sachs suffered the same fate. In fact, Goldman's losses ($.84) were much greater than expected. A sliver of strength in the financial sector could have provided a foundation for the rest of the market. Now that we've seen the numbers and the negative reaction, that seems unlikely.

Apple and Intel will release earnings after the close and they will set the tone for the tech sector. A few days ago, J.P. Morgan said Q3 PC sales came in better than expected. These two companies have the potential to drive the market. Given the price action in the last 24 hours, I doubt that solid results will spark sustained buying. Any move higher will likely be a shorting opportunity.

Earnings were the focal point this week. European credit concerns have temporarily eased and economic releases have been light. Stocks should have been able to move higher for a few more days and this lackluster price action is bearish.

Yesterday's market decline was related to comments made by Germany's Finance Minister. He cautioned that the "grand bargain" being crafted was not going to solve all of Europe's problems. Optimism in the last week reached a feverish pitch and he was trying to "talk the market down".

His statement should not have come as a surprise. Last week, I mentioned that we didn't have any information. Europe has dragged its feet to this point and it is ludicrous to expect a comprehensive plan in a matter of 2 weeks. Investors will have to take larger haircuts on Greek debt, banks will need capital and sovereign debt will be guaranteed against the first 20% of losses. Even if all of these provisions are passed (2 to 3 month process if all EU members agree), who will finance the EFSF? The EU is reaching out to the rest of the world and it knows it can't cover the $1 trillion tab (estimates are as high as $3T) internally.

Overnight, Moody's warned France that it could be downgraded. It has its own debt problems and it is funding the EFSF. Interest rates in Spain and Italy are creeping higher and they are just below 6%.

Yesterday, Cummins said that Europe is already in a recession. We can expect weak economic releases in the future.

China released its GDP overnight. It declined to 9.1% and this is the third straight month it has pulled back. Given the 6% inflation rate, real growth is just north of 3%. China is committed to fighting inflation and it will keep its foot on the brake. They won't ease and the best we can hope for is a reprieve from tightening.

Stocks are cheap and we are at the doorstep of a seasonally bullish period. Asset Managers typically have their wallets out and they are trying to scoop stocks ahead of a year-end rally. The third-year of a presidential term is historically bullish and the bid should be much stronger than it is.

Actions speak louder than words. During yesterday’s market decline, I expected to see a late round of buying ahead of major earnings releases. When that did not materialize it sent a clear message. Asset Managers are not worried that they will miss a year-end rally. They feel that there will be plenty of opportunities to buy stocks and they will error on the side of caution.

Credit concerns and fears of an economic slowdown have resurfaced. Earnings releases after the close for two of the strongest companies could provide support today. However, this market feels like it is living on borrowed time. If the reaction to Apple and Intel is negative, get ready for the next wave of selling.

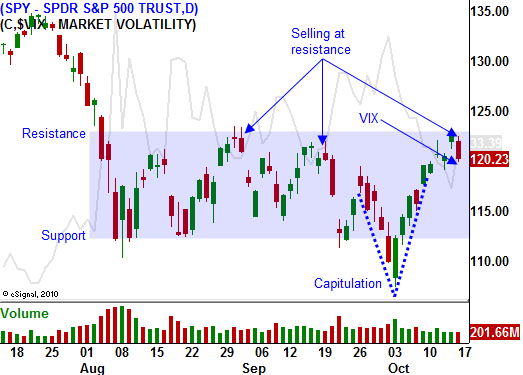

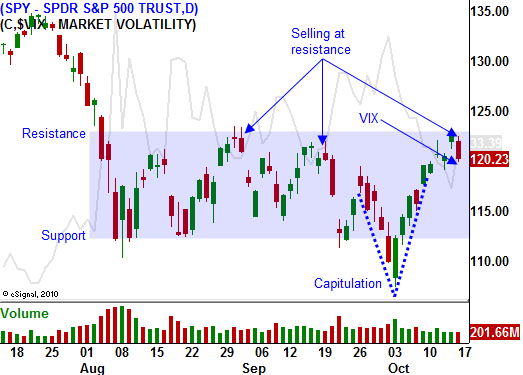

If you've been following my advice, you locked in huge profits on the rally and you are safely on the sidelines. I don't want to give back my gains so I'm keeping my bets small. I will be buying puts on cyclical stocks. If the market rallies tomorrow, I will stop the positions out on a close above SPY 123. The market quickly went from oversold to overbought and there is a chance that Monday’s move was just profit taking. I need to see continued selling to increase my short positions.

If the market declines after the earnings releases tonight, I will add to put positions.

I'd hate to think that the recent 10% move was nothing more than a bear market rally. During a seasonally bullish period, I expected much better. If we roll over now, batten down the hatches.

My forecasts have been spot on and I know from your comments you are making great money. Please do me a favor and request that OneOption be added to Investimonials: click here

The product name is: OneOption

The url is: http://www.oneoption.com

The product category is: newsletters

Once they add my site, testimonials can be posted. Thanks for taking the time. I don't advertise and referrals are my only source of new business.

Daily Bulletin Continues...