Market Searching For A Catalyst. Earings After the Close Thurs Will Determine Direction

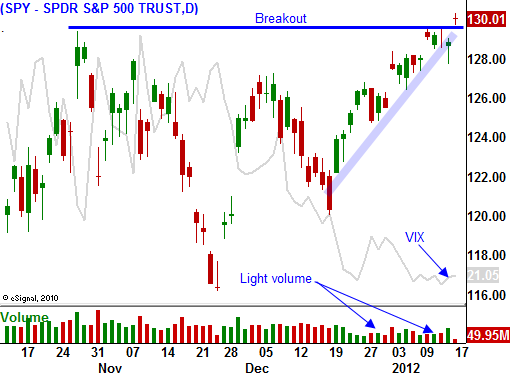

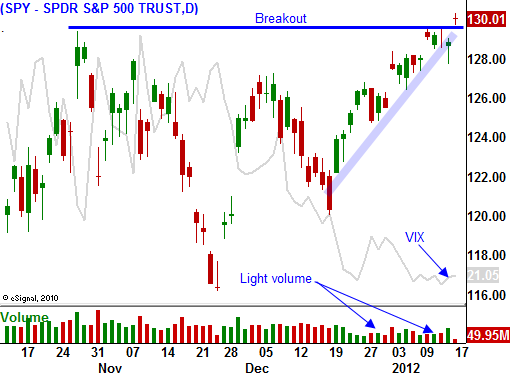

Yesterday, stocks tried to break out above resistance at SPY 130. Positive economic releases out of China (GDP, IP and retail sales) sparked a 4% rally in Shanghai. The Euro credit rating review by S&P last Friday was also in line and a relief rally unfolded early in the day.

This is the type of news that could have resulted in a major breakout. However, stocks slipped throughout the day Tuesday and they briefly fell into negative territory. This morning, stocks attempted another breakout and resistance held.

Goldman Sachs reported better than expected earnings, but revenues were light. This has been a recurring theme and most financials (JPM, C, WFC, PNC, and NTRS) are down after posting results. This will be a busy week for the financial sector and I believe it is due for a pullback.

In the tech sector, LLTC beat estimates and it is trading higher. On the other hand, ASML is trading lower even though it sees growth in Q1. The major tech news will come tomorrow after the close when IBM, Google, Intel and Microsoft report. Stocks typically rally in the beginning of the earnings cycle and this group could generate a market breakout. If the guidance is soft, it could also mark a short-term top as tech stocks back off.

The IMF is pushing the G20 for more funding. They want to increase the "slush fund" to €1 trillion. The US and China are opposed because they want to see European nations pony up a lot more money before they contribute. It might be conceivable that whatever Europe puts up, the remaining members will match. Even this solution seems unlikely since the funds could be used to bail out developed economies (not the original intent of the IMF). Rumor has it the US was even trying to back out from current commitments.

China released property figures overnight and values only increased in 2/70 cities. Prices fell .22% month over month and this is the second consecutive monthly decline. Reports that I've read suggest that China's "housing bubble" is starting. Over 10% of their GDP comes from residential housing. That is twice as high as it was in the US in 2007. When the housing cycle reverses, we know how devastating it can be in the overall economy. Furthermore, foreign direct investment fell 12.7% in December Y/Y. China is losing its luster.

Germany is the strongest country in Europe and it projects 2012 GDP growth to come in at 1%. Q4 GDP fell .1% and I believe these projections are overly optimistic.

The World Bank lowered its projections for 2012. It expects high-income countries to grow 1.4% vs. a previous projection of 2.7%. That represents a 50% downward revision.

In the short run, the ECB's liquidity maneuver worked. It has temporarily provided European banks with much-needed liquidity and credit concerns have eased. In another month, we will know how much money European banks have borrowed from the ECB. Many analysts believe that the number will exceed €1 trillion.

On the surface, the market will like this number. However, it shows how desperate European banks were. The risk is not gone; it has simply shifted from banks to the ECB. The ECB's balance sheet is already as big as it was during the financial crisis in 2008.

The Fed’s unlimited credit line to the ECB makes me very nervous but it is consistent with the “all in” approach. Our balance sheet is not much stronger. If Europe fails, we all fail anyway so we might as well support them.

As earnings season unfolds during the next few weeks, I believe the appetite for stocks will wane. Guidance will be cautious and Asset Managers will take profits. European credit concerns will flare up when Spain and Italy auction longer-term bonds.

I am currently short financials and long the VIX. I believe financials will struggle the rest of the week and option implied volatilities could spike on the first meaningful market decline. To hedge these positions I will day trade strong stocks if the SPY does breakout above 130 and it has follow through.

I'm using this strategy because the deltas are high and my slippage is low (stocks are liquid and bid/ask spreads are tight). I can be in and out of the positions quickly and lock in profits. These gains will help me offset the carrying costs of my bearish positions. I don't want to be long overnight because the rug can get pulled out from under me at anytime.

If the market can't breakout this week, the selling pressure will build and my bearish positions will be in great shape.

On the surface, everything looks great. Economic conditions in the US are decent, earnings will beat expectations and credit conditions in Europe have improved. Don't be lulled into this rally. Carry neutral basket of positions where you are long relative strength and short relative weakness. This approach will work regardless of which way the market breaks out. Once we know the direction, we can exit the losing side.

Daily Bulletin Continues...