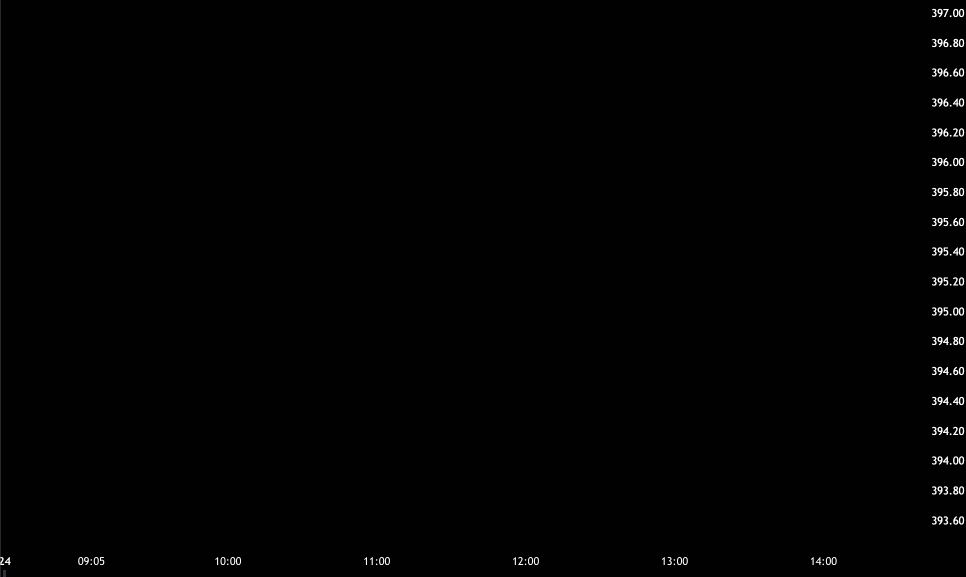

Daily Market Analysis

2023-02-24

Review our intraday commentary to learn how we interpret price action and build a market narrative.

Drag the blue slider to reveal the day's price action. Dots on the timeline represent comments and can be clicked. View the table below for all market-related comments and annotated charts (including those from after hours).

Abbreviated Comments View all

Click to expand content and reposition slider.

| 13:08:29 Pete |

I recorded a video and I went over legging out of spreads. Again, for most of you the best way to exit is to close the spread for a loss. Legging out changes the profile of the original trade making... |

|---|---|

| 13:46:08 Pete |

Higher low double bottom forming but I would not read too much into this. Lots of mixed candles and we are in the middle of the range. Still below the D1 Low+ trendline and the 50-day MA. For me to... |

| 10:00:44 Pete |

I am just calling out stocks. For the long side WAAAAAY too early for that. I would need to see us blow thru the hod and into the gap on a bullish cross. That is not likely. I believe that... |

| 10:09:03 Pete |

It would be pretty cool to do a real-time Max Pain calc for 0DTE SPY/SPX. I might consider it. Would take time to dev and not taking new projects until we fix some of these nagging issues. |

| 10:21:14 Pete |

The tone was set before the PCE. ECB will hike 50 basis points in March and more hawkish "Fed speak" yesterday. The number added to selling pressure that was already there. @Ruddiculous: Question I'm a little surprised that there was this... |

Limited Access Only

Become a OneOption member to view all Daily Market Comments. Please visit our Start Here page to learn more about our system and how to become a member via our Free Trial.

Start Free Trial