Daily Market Analysis

2023-01-04

Review our intraday commentary to learn how we interpret price action and build a market narrative.

Drag the blue slider to reveal the day's price action. Dots on the timeline represent comments and can be clicked. View the table below for all market-related comments and annotated charts (including those from after hours).

Abbreviated Comments View all

Click to expand content and reposition slider.

| 09:30:09 Pete |

PRE-OPEN MARKET COMMENTS WEDNESDAY – The first trading day of the year started off on a positive note and that enthusiasm died after the first 15 minutes. Sellers flexed their muscles and the gap reversal was underway. The up trendline... |

|---|---|

| 09:47:53 Pete |

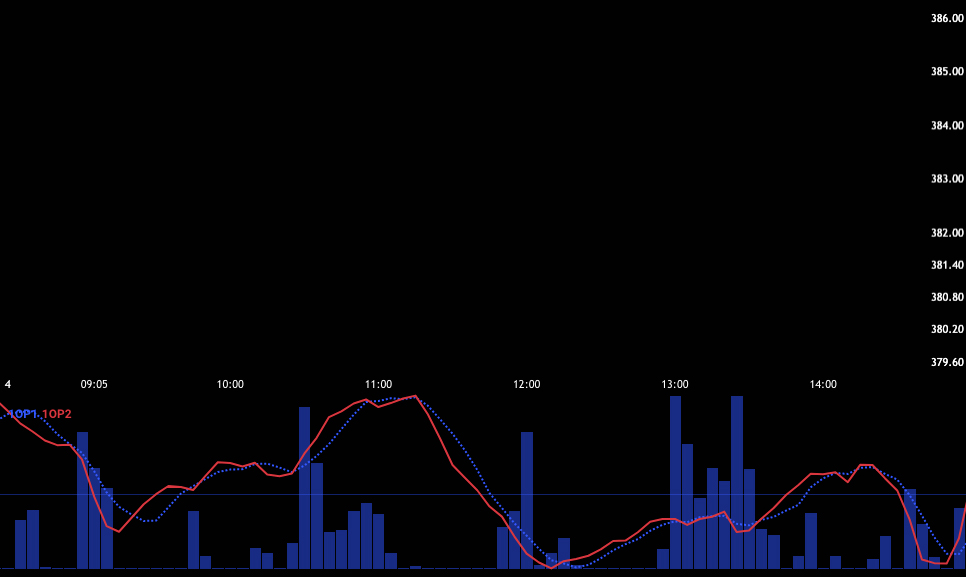

Gap up, 1OP bearish cross, bearish hammer off of hod so far. I would not rush in to buy here. We saw this movie yesterday. |

| 09:57:31 Pete |

The difference in the first 30 min of trading today vs yesterday is that there is support. We are not stacking red candles. That should be your take away so far. That means you have a little time to find... |

| 10:00:58 Pete |

ISM man out |

| 10:07:51 Pete |

Choppy, chunky price action with a slight downward bias. I would follow the bear 1OP cross and the gap fill |

Limited Access Only

Become a OneOption member to view all Daily Market Comments. Please visit our Start Here page to learn more about our system and how to become a member via our Free Trial.

Start Free Trial