Daily Market Analysis

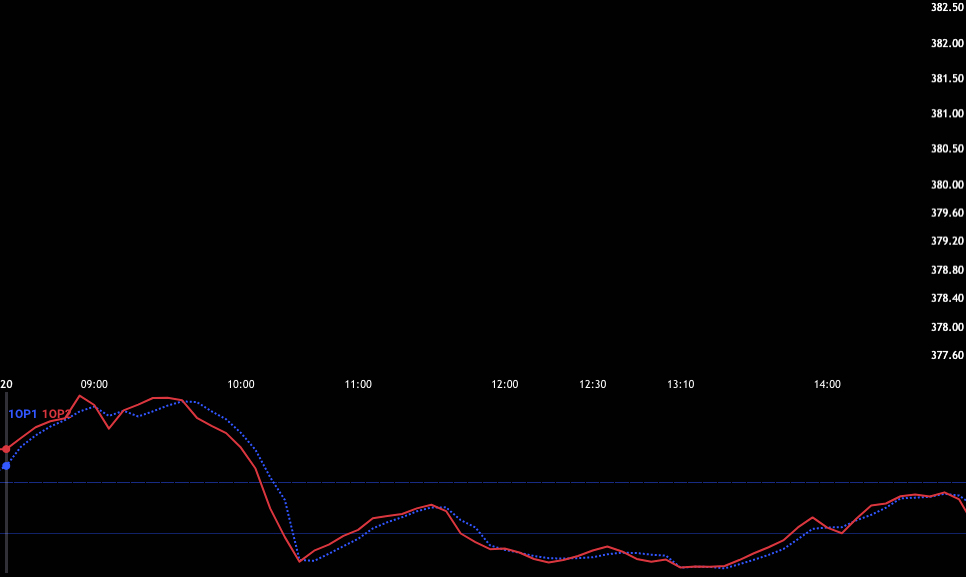

2022-12-20

Review our intraday commentary to learn how we interpret price action and build a market narrative.

Drag the blue slider to reveal the day's price action. Dots on the timeline represent comments and can be clicked. View the table below for all market-related comments and annotated charts (including those from after hours).

Abbreviated Comments View all

Click to expand content and reposition slider.

| 09:32:40 Pete |

Short FXI long term swing position with size. Scaling the first half of the position today and I will add < 100-day MA. |

|---|---|

| 09:36:56 Pete |

1OP bearish cross pending. I would like to see this bearish cycle push us < prior day low. I would short that. Shorting /ES here makes little sense since we are so close to it. |

| 09:40:44 Pete |

Short 1/4 of FXI at $27.50 |

| 09:55:57 Pete |

I am ready to short, I just need to see some follow thru. So far this little poke has been met by support. The volume is light so your guard should be up. Make no mistake we are in holiday... |

| 10:01:19 Pete |

That red candle on /ES got shorts excited and right now they are taking heat. That is why we have to wait for tech confirmation. |

Limited Access Only

Become a OneOption member to view all Daily Market Comments. Please visit our Start Here page to learn more about our system and how to become a member via our Free Trial.

Start Free Trial