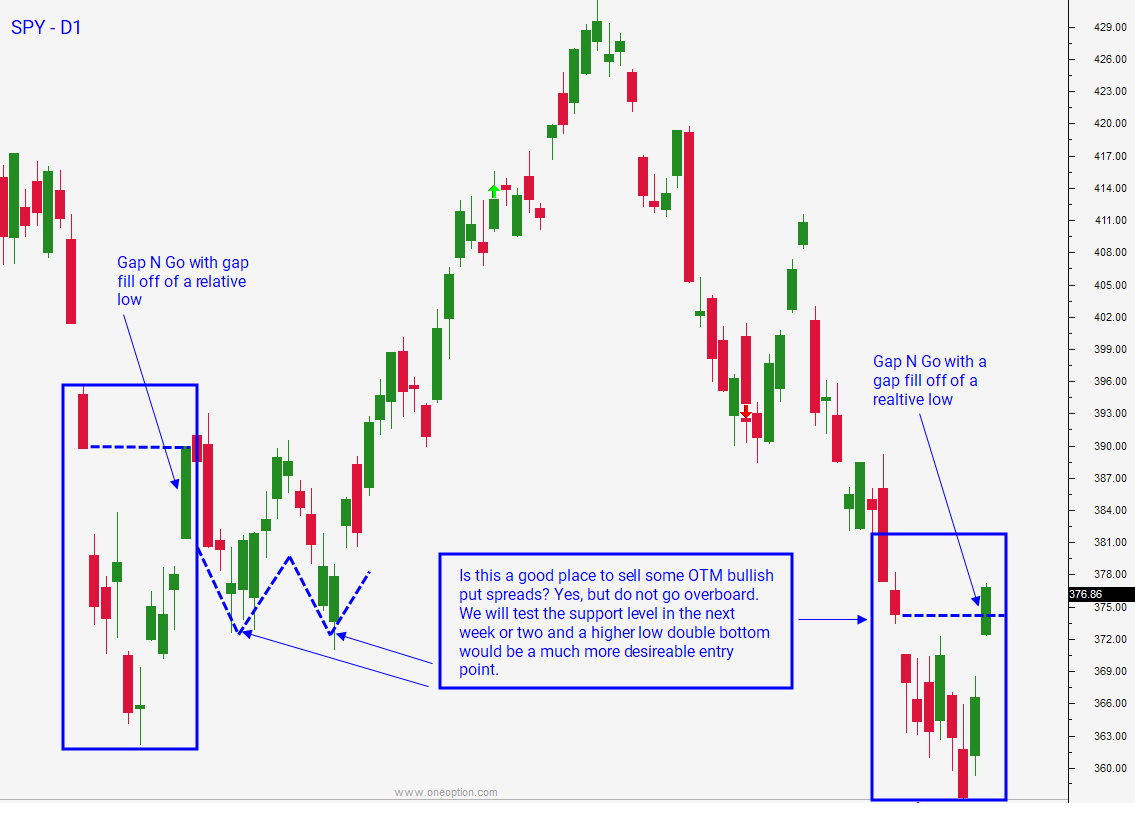

Daily Market Analysis

2022-10-04

Review our intraday commentary to learn how we interpret price action and build a market narrative.

Drag the blue slider to reveal the day's price action. Dots on the timeline represent comments and can be clicked. View the table below for all market-related comments and annotated charts (including those from after hours).

Abbreviated Comments View all

Click to expand content and reposition slider.

| 09:45:01 Pete |

As a pro, I am more inclined to fade this move than I am to join it. The danger is that others might feel the same way. On a move of this magnitude, early shorts will get squeezed and that... |

|---|---|

| 09:55:40 Pete |

rrathk1 wrote: @Pete in regards to "retracement", are you referring to the closing of next candle(s) or the wick?On that red candle you want the next candle to close near the close of the bear engulf and you do NOT want... |

| 10:07:14 Pete |

We filled in the gap from Sept 23 on the first shot. That is impressive. |

| 10:25:46 Pete |

|

| 10:32:31 Pete |

From an ES standpoint you could lament that you missed a great rally gap and go move. I don't see it that way at all. Chasing these moves early in a bear market is dangerous. At very least you need... |

Limited Access Only

Become a OneOption member to view all Daily Market Comments. Please visit our Start Here page to learn more about our system and how to become a member via our Free Trial.

Start Free Trial